how is capital gains tax calculated in florida

Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

For starters the capital gains tax on your crypto can either be.

. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

Capital gains tax is owed when you sell a non-inventory asset at a higher price than you paid resulting in a realized profit. Long-term capital gains taxes on the other hand apply to capital gains made from investments held for at least a year. When you sell your gain or.

You can calculate capital gains taxes using IRS forms. 250000 of capital gains on real estate if youre single. Heres an example of how much capital gains tax you might pay if you owned the house for more or less than 12 months.

Record each sale and calculate your hold. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too.

Its called the 2 out of 5 year rule. Section 22013 Florida Statutes. Ad Import tax data online in no time with our easy to use simple tax software.

That applies to both long- and short-term capital gains. Capital gains can be short-term where the asset is sold in 1 year or less or it can be long-term capital gain where the asset is sold after 1 year. How Much Is Capital Gains Tax In Florida On Stocks.

TaxAct helps you maximize your deductions with easy to use tax filing software. Capital gains tax cgt is a tax that applies in australia when you sell an asset shares or investment at a profit. Second if you sell your home there may be a capital gains tax on the profit realized from the sale.

For example if a person earns 50000 per year and earns a capital gain of 1000 they will have to pay 150 in capital gains taxes to the IRS. Capital Gains Taxes on Property. Special Real Estate Exemptions for Capital Gains.

It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. At the federal level and in some states these are taxed at a lower percentage than normal income.

Capital gains tax rates on most assets held for a year or less correspond to. The IRS typically allows you to exclude up to. In 2020 the capital gains tax rates are either 0 15 or 20 for.

No capital gains tax is incurred on inventory assets. Capital gains tax might result from selling your home stocks bonds commodities mutual funds a business and other similar capital assets. A short-term capital gains tax from 10 to 37 on crypto assets held for less than one year or.

You have lived in the home as your principal residence for two out of the last five years. The two year residency test need not be. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Total Capital Gains Tax. A good capital gains calculator like ours takes both federal and state taxation into account. There is currently a bill that if passed would increase the.

New Hampshire doesnt tax income but does tax dividends and interest. Hawaiis capital gains tax rate is 725. There may be a bracketed system where the rate is higher as the dollar value of the capital gains go up or there may be a.

The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. 500000 of capital gains on real estate if youre married and filing jointly. Capital gains and losses are taxed differently from income like wages interest rents or.

You dont have to pay capital gains tax until you sell your investment. A capital gains tax is a tax you pay on the profit made from selling an investment. To calculate and report sales that resulted in capital gains or losses start with IRS Form 8949.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. The tax paid covers the amount of profit the capital gain you made between the purchase price and sale price of the stock real estate or other asset. A Florida capital gains tax calculator will help you estimate and pay taxes based on your situation.

You can use a capital gains tax rate table to manually calculate them as shown above. A long-term capital gains tax from 0 to 20 on crypto assets held for more than one year Note that evaluating the holding period is an important step in calculating your crypto. It can jump to 20 if your combined income exceeds this amount.

Long-term capital gains on the other hand are taxed at either 0 15 of 20.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Calculator 2022 Casaplorer

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Florida Real Estate Taxes What You Need To Know

How High Are Capital Gains Taxes In Your State Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

12 Ways To Beat Capital Gains Tax In The Age Of Trump

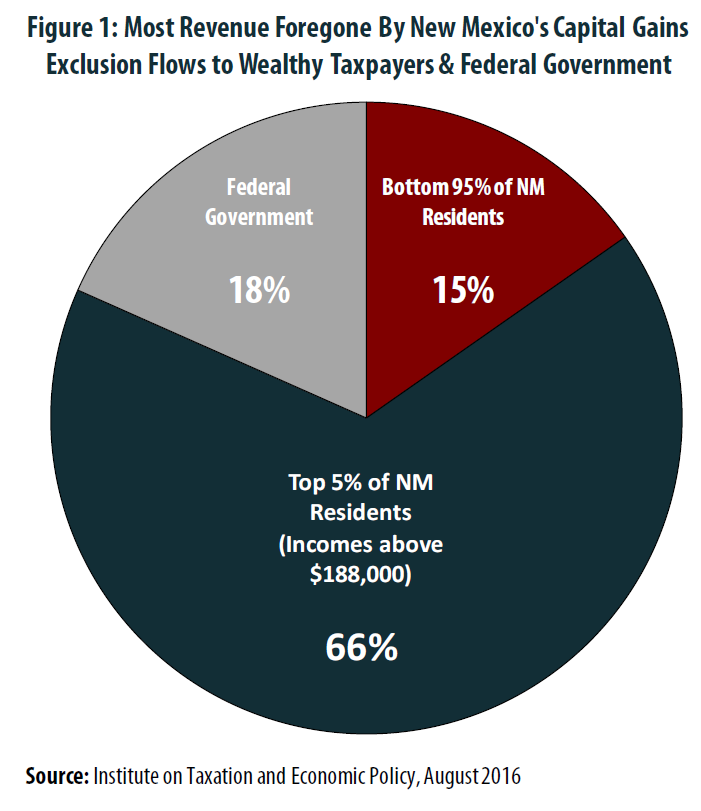

The Folly Of State Capital Gains Tax Cuts Itep

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes